Corporate Green Power Progremme... What is in it for the off-taker?!!

Corporate Green Power Programme (CGPP), the latest initiative by the Government of Malaysia to achieve the national RE target…

In short, under this programme,

The investor will be a Solar Power Producer who builds, owns, and operates the Solar Power Plant of size between 5MW to 30MW; and sells Solar energy to the Corporate Consumer (users with Maximum Demand >1MW) via Virtual Power Purchase Agreement (VPPA).

For sure the players in the industry who are sitting on cash are busy preparing to apply to this programme.

By looking at the financial transaction of this CGPP VPPA, I am wondering what is in it for the off-taker…

Of course there are plenty of benefits of off-taking Solar Power.

But in terms of monetary benefit in this CGPP, I felt the off-taker may have to pay more for a unit of Solar Energy, probably at least for the first few years??!!

Looking at the current Medium Voltage Industrial tariff rate which is RM0.355 per kWh + 1.6%KWTBB or about RM0.361 per kWh.

And SMP which is about RM0.25 per kWh.

If the Investors do normal Solar PPA with the client instead of CGPP, he probably can offer the off-taker a Solar Tariff rate of RM0.30 to RM0.32 per kWh?!

And the off-taker can save about RM0.04 to RM0.06 per kWh.

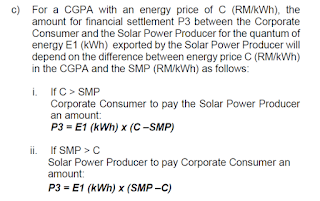

Based on the following CGPP financial transaction, What happened to the off-taker??

The off-taker need to pay:-

- TNB - RM0.361 per kWh

- Solar Power Producer - at least RM0.05 per kWh?!

When the Investors can sell at RM0.30 to RM0.32 per kWh, would they set their “C” at a rate lower than SMP (RM0.25)?

End up, the off-taker of CGPP would pay RM0.40 plus per kWh?

Yes, SMP likely may go up. But when everyone is looking for the “cheapest” instead of cheaper and “NOW instead of future”. Would it be difficult to find an off-taker for this programme?

Or something in the financial transaction that I misinterpreted?

Comments

Post a Comment